After the traditional Spring Festival sales off-season, the auto consumer market has finally ushered in the recovery of all things. As some car companies/brands released their sales data for March, we saw a general increase in sales and a reshuffling of sales leaders in the new car-making forces.

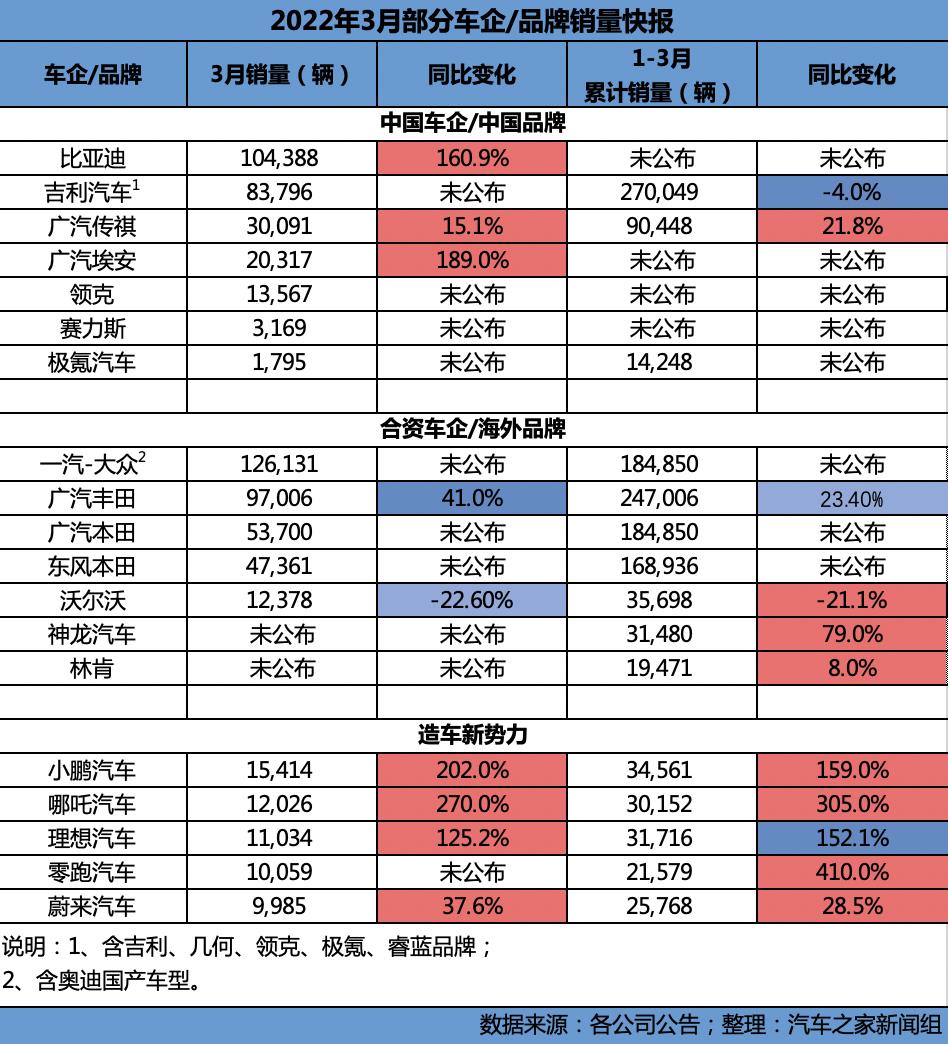

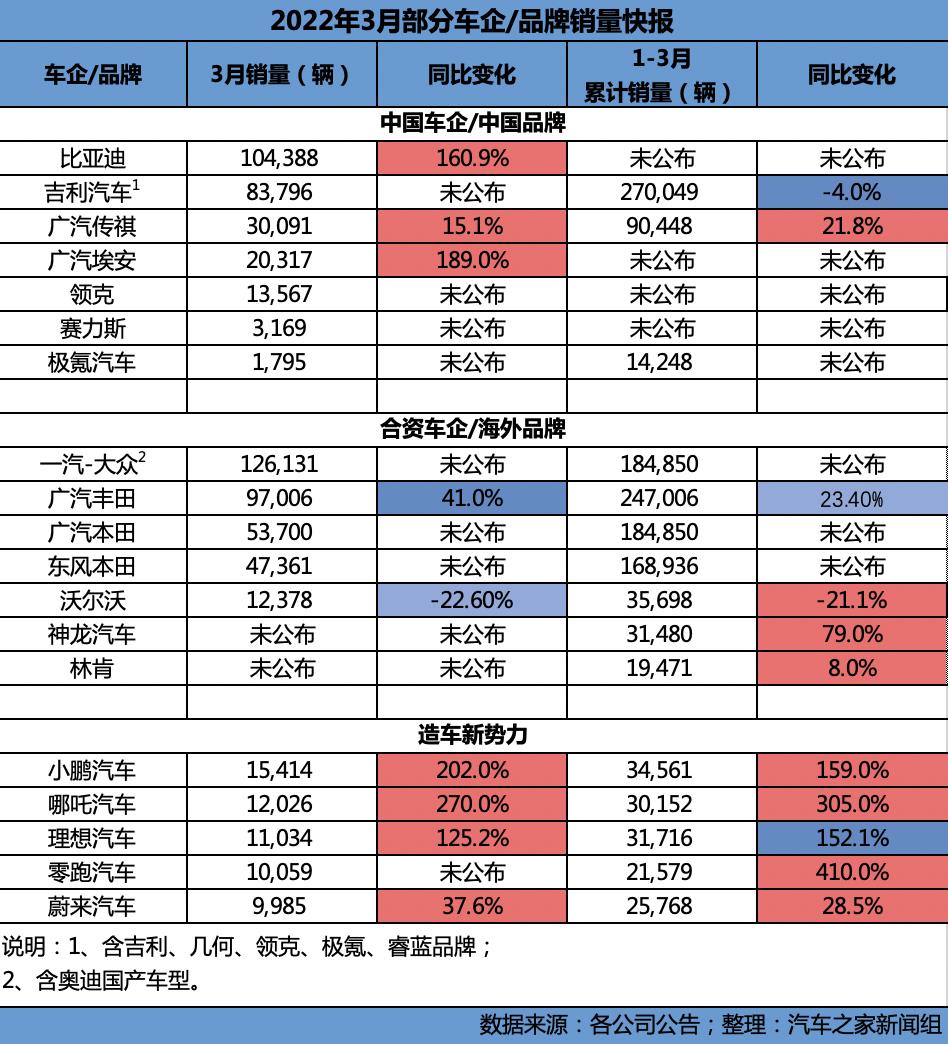

As of April 8th, there are a total of 7 Chinese car companies/brands, 7 joint venture car companies/overseas brands, and 6 new car-making companies that have announced their sales. The following is the specific data:

2022 March Car Sales Chart

-

Chinese car companies/brands

As of April 7, a total of 7 Chinese car companies/brands have announced their own sales. Large traditional automakers including Great Wall, Changan, Chery, and SAIC have yet to release sales figures for March. Among the companies that have released data, BYD has achieved rapid growth and announced that it will focus on the new energy vehicle business; Aion continued to maintain rapid growth, with sales exceeding 20,000 units in March.

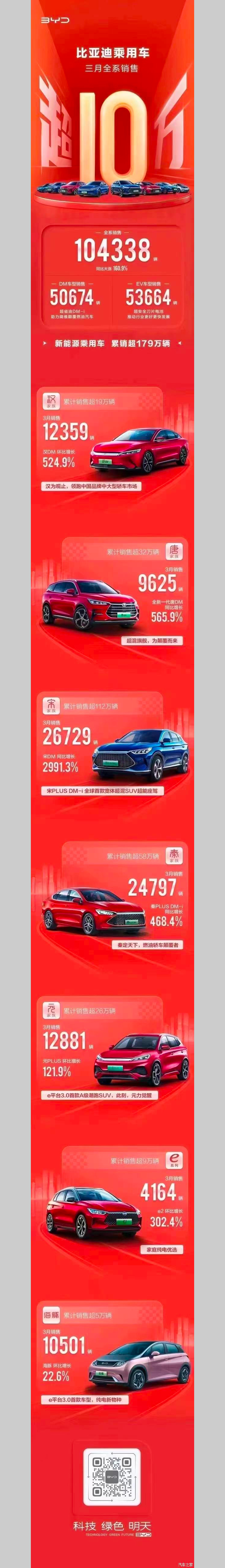

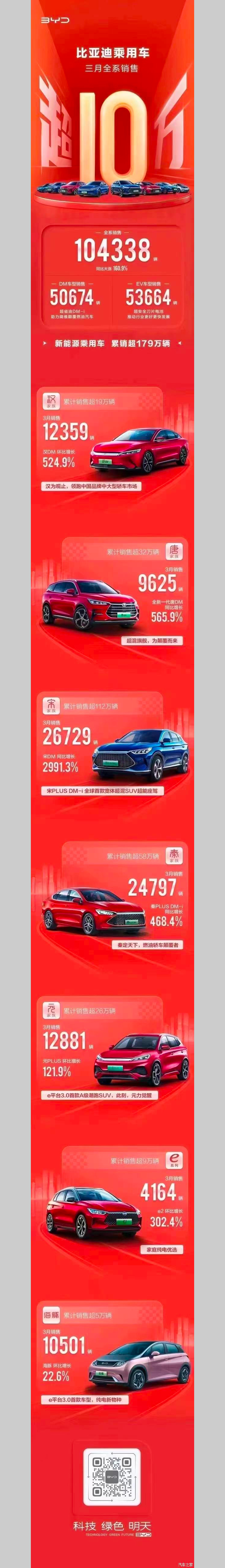

BYD 2022 March Sales Data

In March, BYD’s passenger car sales reached 104,338, a year-on-year increase of 160.9% and a record high. At the same time, BYD announced that it will stop the production of fuel vehicles from March, focusing on EV pure electric and DM plug-in hybrid, becoming the first car company in the world to stop the production of fuel vehicles.

In terms of sales, in March, BYD’s EV pure electric models sold 53,664 units, a year-on-year increase of 229.2%; DM plug-in hybrid sales were 50,674 units, a year-on-year increase of 615.2%. In terms of specific models, Han sold 12,359 units, Tang sold 9,625 units in March, Qin family sold 24,797 units in March, Song family sold 26,729 units, Dolphin sold 10,501 units in March (the cumulative sales since listing are nearly 60,000 units), Yuan family units sold in March A total of 12,881 units were sold.

Regarding the suspension of fuel vehicle production, BYD has made strategic adjustments around the national “dual carbon” strategic goal and will stop the production of fuel vehicles from March. And said that it will continue to provide comprehensive services and after-sales guarantees for existing fuel vehicle customers, as well as the supply of spare parts throughout the life cycle, to ensure fuss-free travel.

Aion’s March sales reached 20,317 units, a year-on-year increase of 189%. Official sources say that the rapid growth of Aion’s sales is due to the fact that the factory’s capacity expansion and upgrade were completed in February, and the production capacity has doubled to ensure supply; innovative ways of marketing the product, especially the comprehensive innovation and change brought about by the mixed-ownership reform. At present, AION S Plus (parameters | inquiry), AION V Plus, AION LX Plus, AION Y, etc., have mixed performances in the market segment.

-

Joint venture car companies/overseas brands

Joint venture car companies/overseas brands have always been “passive” in reporting sales, so there are not many sales announced at present. FAW-Volkswagen has been affected by the shutdown of the epidemic, and its production has declined; GAC Honda and Dongfeng Honda have experienced year-on-year declines to varying degrees due to parts shortages; Shenlong Automobile is returning to the growth track with the joint efforts of Dongfeng Peugeot and Dongfeng Citroen.

FAW-Volkswagen sold 126,131 vehicles in March (excluding Audi imported cars), ranking first among car companies in terms of sales. Among them, the total sales volume of the Volkswagen brand in March was 70,198. FAW-Volkswagen said that due to the impact of the epidemic, some factories reduced or even stopped production in March, and the overall production of the Volkswagen brand in March decreased by about 40% year-on-year; the production of its Changchun base fell by more than 60% year-on-year in March, and many hot-selling models were limited by production capacity. The production capacity of Chengdu, Tianjin, and Qingdao bases have also been reduced to varying degrees, about 30%-50%. At the same time, the outbreak of the epidemic has also had an adverse impact on the sales and logistics sides.

Overall, Honda’s car sales in March were 101,061 units, a year-on-year decrease of 33.2%. Specifically, GAC Honda sold 53,700 vehicles in March; Dongfeng Honda sold 47,361 vehicles in March. The reason for the year-on-year decline in overall sales is still the shortage of parts and components caused by the epidemic.

In terms of cumulative data, the cumulative sales of the Honda brand from January to March 2022 were 353,786 units, a year-on-year decrease of 9.3%, of which hybrid models accounted for 54,034 units. From January to March 2022, GAC Honda’s cumulative sales of vehicles will be 184,850; Dongfeng Honda’s cumulative sales of vehicles from January to March 2022 will be 168,936.

The cumulative sales volume of Shenlong Motors in the first quarter was 31,480 units, a year-on-year increase of 79%. The monthly sales volume achieved positive year-on-year growth for 16 consecutive months. On March 1, the Stellantis Group released the “Dare Forward 2030” strategic plan, which mentioned that the Shenlong Automobile adopts a new business model, the marketing of the Peugeot brand is led by the Stellantis Group, and the marketing of the Citroen brand is led by Dongfeng Motor. This is the previously discussed “two rooms and one hall” plan.

Dongfeng Group also announced on March 2 that the group is now negotiating with Stellantis on a new business arrangement for Shenlong Automobile Co., Ltd. As of the date of the announcement, there is no legally binding agreement between Stellantis and the Group in relation to the new business arrangement. The final terms of the definitive agreement are subject to further negotiation between the parties. The company will make further announcements on the progress of the negotiation in due course.

-

New forces in car building

The new car-making forces have always been “activists” in announcing sales, and on April 1, they released their March transcripts one after another. The performance of the new car-making power team in March was still very exciting, and the top echelon became a “small” combination. Xiaopeng Motors continues to lead the new car-making forces, and Nezha Motors is also eyeing it. Li Auto is still making progress, and NIO ranks at fifth, but the overall growth trend is still maintained.

Xiaopeng Motors announced the delivery of new cars in March and the first quarter of 2022. Among them, a total of 15,414 units were delivered in March, an increase of 148% month-on-month and a year-on-year increase of 202%; the cumulative delivery volume in the first quarter reached 34,561 units, the same period last year. 2.6 times. As of the end of the first quarter of 2022, the cumulative historical delivery of Xpeng Motors has exceeded 170,000 units.

In terms of single-model delivery, in March, Xpeng P7 exceeded 9,000 for the first time and delivered 9,183 units, setting a new record for pure electric models of the new force. Another hot-selling model, the Xpeng P5, delivered 4,398 units in March, with a cumulative delivery of 10,486 units in the first quarter, an increase of 38% from the fourth quarter of last year. 1833 units of the G3 series were delivered.

In order to accelerate the delivery of orders in hand, as well as new orders this year, Xiaopeng completed the technical transformation of the Zhaoqing factory during the Spring Festival. Entering the second quarter, Xpeng Motors’ various hot-selling models will usher in full force. With a rich product matrix and a forward-looking sales, service, and charging network, Xpeng Motors will accelerate to meet the ever-expanding market demand.

Nezha Auto delivered 12,026 new vehicles in March, a 270% increase compared to March last year. In addition, the cumulative delivery volume of Nezha in the first quarter of this year reached 30,152 vehicles, a year-on-year increase of 305% compared with the 7,443 vehicles in the first quarter of last year.

Nezha Auto maintained a strong growth momentum last year. The number of new cars delivered in February this year reached 7,117, a year-on-year increase of 255%. On this basis, and with the impact of the price increase in March, Nezha Auto was still able to perform in the third quarter. Yue handed over a dazzling transcript, which is really impressive.

In March 2022, Li Auto delivered 11,034 units, a year-on-year increase of 125.2%; in the first quarter of 2022, Li Auto delivered a total of 31,716 units, a year-on-year increase of 152.1%; since delivery, the cumulative delivery of Li Auto ONE has reached 155,804 units.

Due to the impact of the epidemic in the Yangtze River Delta, the supply of some parts and components has affected production, and Li Auto is taking more measures to ensure the supply of parts, ensure production as much as possible, and shorten the waiting period for users who book Li ONE to pick up the car. As of March 31, 2022, Li Auto had 217 retail centers across the country, covering 102 cities; 287 after-sales maintenance centers, and authorized sheet metal spray centers, covering 211 cities.

Leapmotor officially released the delivery data for March 2022. A total of 10,059 units were delivered that month, breaking the 10,000-unit mark for the first time, with a month-on-month increase of 193%. The year-on-year growth rate of Leapmotor’s monthly deliveries has exceeded 200% for 12 consecutive months. The cumulative delivery volume in the first quarter of 2022 was 21,579 units, a year-on-year increase of 410%.

At present, Leapmotor has three models of Leapmotor S01, T03, and C11 on sale, covering the market of small pure electric vehicles, miniature pure electric vehicles, and medium-sized pure electric SUVs. In the near future, it will also launch its first pure electric medium and large-sized sedan built on the C platform, the Leapmotor C01. It is reported that the new car has a body length of 5050mm, a long battery life of 700km, the largest trunk space of 496L in its class, and a 0-100km/h acceleration time of 3 seconds. The car is expected to be officially released in the second quarter of 2022.

On April 1st, NIO announced that the brand’s March 2022 deliveries will be 9,985 units, a year-on-year increase of 37.6%. At the same time, in the first quarter of 2022, the brand delivered 25,768 new vehicles, a year-on-year increase of 28.5%. As of March, NIO has delivered a total of 192,838 new vehicles.

Among the new cars delivered by NIO in the first quarter or in March, the ES6, EC6, and ES8 SUVs are of course the main force. However, NIO’s first mass-produced pure electric sedan, the ET7, has also delivered on March 28. As of March 163 vehicles were delivered on the 31st.

In addition, NIO officially announced that the 2022 ES8, ES6, and EC6 models equipped with the latest smart cockpit hardware are expected to be released in late May this year, and the smart cockpit upgrade plan for existing users will also be announced at that time; as a blockbuster new car, it was born in the NT2 The platform’s new five-seat SUV ES7 will also be released simultaneously, and we can look forward to it together.

Conclusion:

In March, the auto market, which had just passed the off-season stage and is beginning to pick up. Chinese car companies/brands represented by BYD and GAC Aion have achieved rapid growth, and a new product from the background of traditional car manufacturing, Zeekr Automobile, has also begun mass production and delivery. Some companies continued to be troubled by the shortage of parts and components, and the decline was more obvious. The French car representative Shenlong Motors, is gradually returning to its former glory, while Lincoln set a new sales record in the first quarter.

The new car-making forces are even more exciting. The top three continue to shuffle. In March, it was the “Xiao Nali” combination. Xiaopeng Motors, which was affected by the factory renovation last month, quickly returned to the leading position and continues to maintain rapid growth. NIO, which has occupied the champion position many times before, performed fairly in March and only ranked fifth. Of course, NIO is about to launch a large wave of new products to stimulate market demand, which is expected to show in the following months.