On December 8th, the China Passenger Car Association (CPCA) announced the passenger car data for November. Focus on a few key points. . .

-

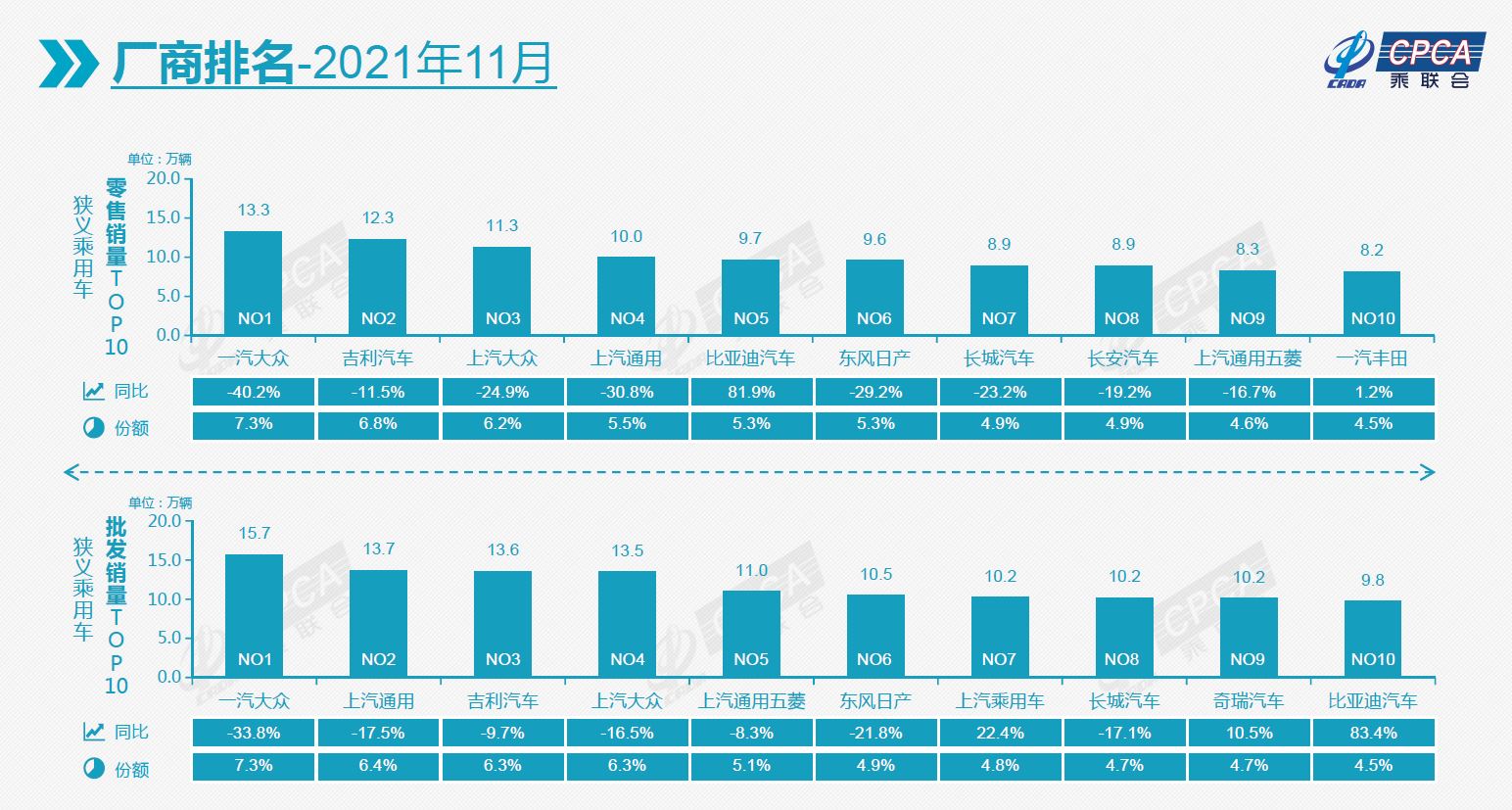

Overall retail sales are poor: Passenger car retail sales in November were 1.816 million units, a year-on-year decrease of 12.7% and a decrease of 6% from the previous year. The main unfavorable factors in November were the epidemic. First of all, the spread and recurrence of the epidemic, as well as weak employment expectations and confidence, and weak growth in consumer demand were unfavorable for low and medium-class models.

-

Exports remain strong: In November, CPCA recorded an export of 170,000 passenger vehicles, a year-on-year increase of 79%. Among them, the export of local brands was 130,000, a year-on-year increase of 26%, and the export of joint ventures and luxury brands (Volkswagen, etc.) was 39,000, a year-on-year increase of nearly 4 times.

-

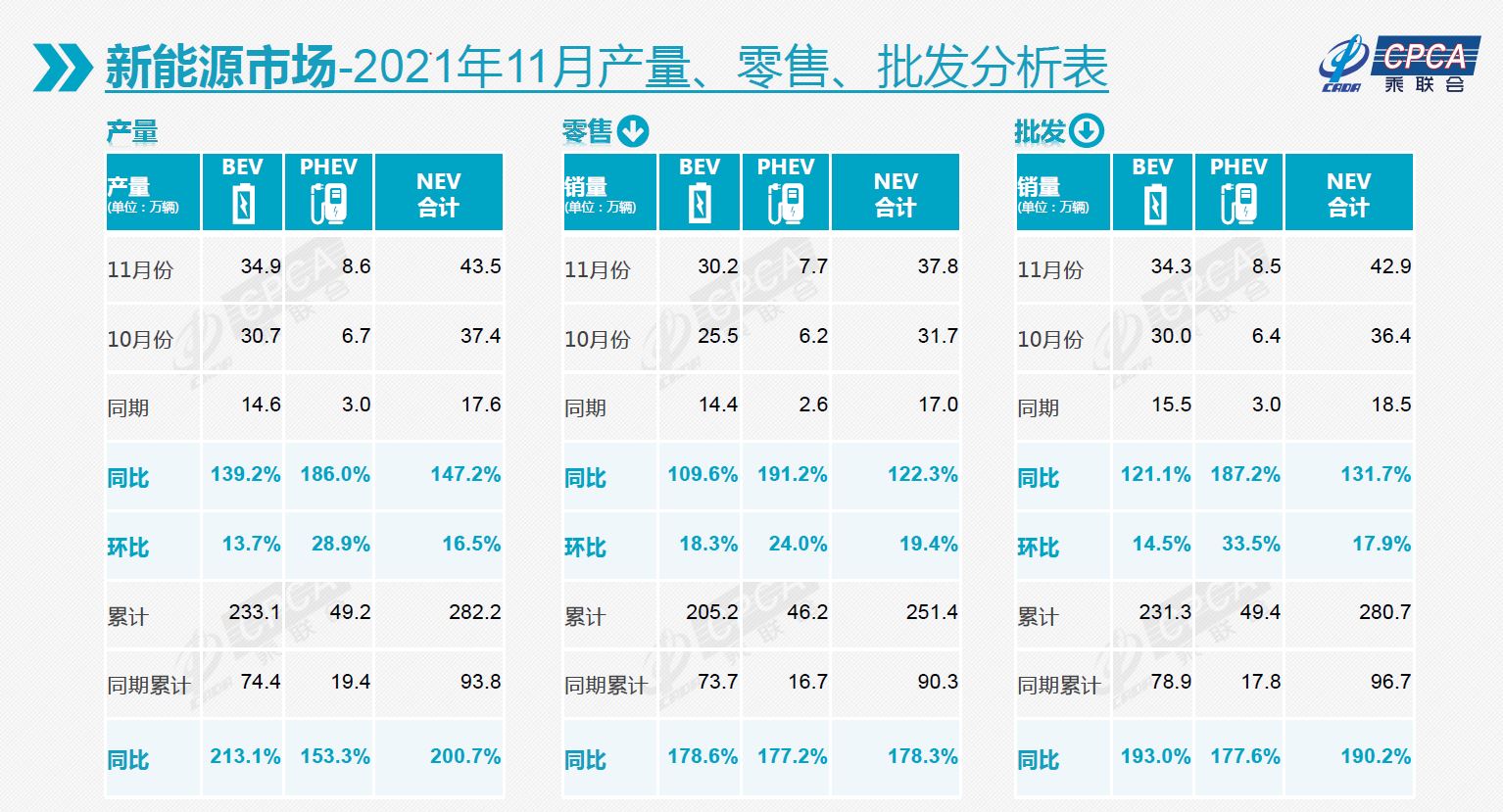

EV penetration rate has further increased: In November, the domestic retail penetration rate of new energy vehicles was 20.8%, which is a significant increase compared with the 5.8% penetration rate for the whole year of 2020. However, there are big differences between each level. In addition to brand factors, there are also market demand factors. For example, the market segments of short-distance mobility vehicles and the second family car perform well. There are 14 companies with wholesale sales exceeding 10,000 units, which is a substantial increase from the previous period, including: BYD 90,546, Tesla China 52,859, SAIC-GM-Wuling 50,141, Great Wall Motor 16136, Xiaopeng Motors 15,613, GAC 15035 vehicles, 14482 Chery cars, 13,485 ideal cars, 13090 Geely cars, 12225 SAIC passenger cars, 11986 SAIC Volkswagen, 10878 NIO, 10705 FAW-Volkswagen, 10013 Hezhong Automobile.

-

The national passenger car market will rebound in December: The node before the Spring Festival is a period of concentrated outbreak of first purchase users, and the auto market must have a strong performance. The dark moment of automotive chip supply in the third quarter has passed. It was originally expected that the improvement of chip supply will prompt a rebound in production. To the level of November last year, the actual increase was about 14% month-on-month, but it has not returned to last year’s level, and the bottleneck factor of opaque supply is still there.

-

Encourage high-energy-density batteries: new energy vehicle power batteries face the pressure of guaranteeing lithium, cobalt, nickel, and other ore resources and rising prices, so there is an idea to develop lithium iron phosphate. The development of new energy passenger vehicles in 2021 is mainly due to the huge increase in lithium iron phosphate batteries.